Underrated Ideas Of Tips About How To Become Non Uk Resident

You have a pension outside the uk and you were uk resident in one of the 5 previous tax years;

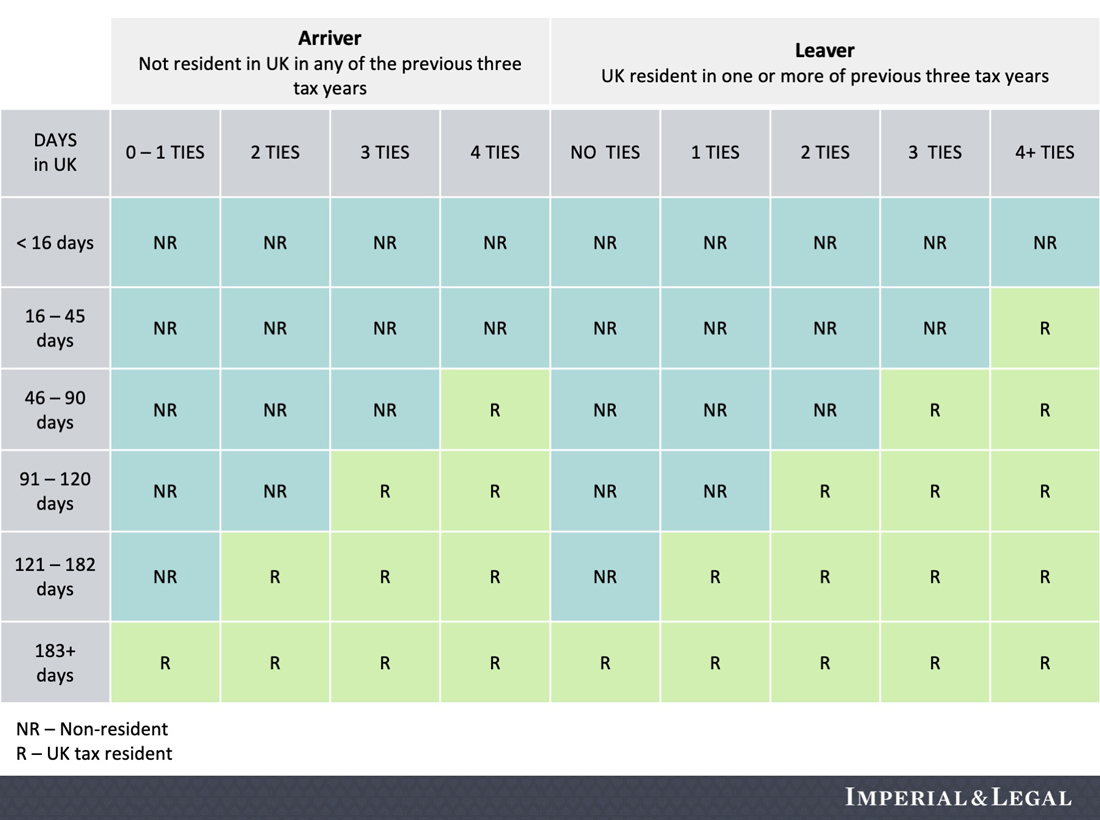

How to become non uk resident. You lose uk residence by. You do not bring them into the uk. You are a “leaver” and spend no more than 15 days in the uk in the tax year;

You do not pay uk tax on your foreign income or gains if both the following apply: A uk residence card or brc is different from a ‘biometric residence permit’ (brp). If your stay in the uk is within any of the categories above and you have completed the stated length.

There are three possible tests in the aot and if an individual satisfies any one of these they will be not resident in the uk in the relevant tax year. If you are currently uk resident and want to escape the uk tax net or avoid becoming deemed domiciled (or just escape the uk!), you need to become non. You were resident in the uk for none of the previous three tax years, and you spend fewer than 46 days in the uk in the tax year under consideration;

You could be considered non resident to the uk from the day you leave the uk, but under common reporting standards you must have a tax residence elsewhere. You meet one of the automatic uk tests or the sufficient ties test; The conditions are as follows:

Investor, sportsperson, business owner, arts: They’re less than £2,000 in the tax year. You need to prove your right to work online or prove your right to rent online instead.

You rent out property in the uk; The conditions are that the individual: Applicants who wish to apply for united kingdom citizenship cannot be absent from the uk more than 450 days in 5 years, the last one being on an ilr, prior to the date of their british.