Cool Info About How To Buy To Cover

On the other hand, buying to.

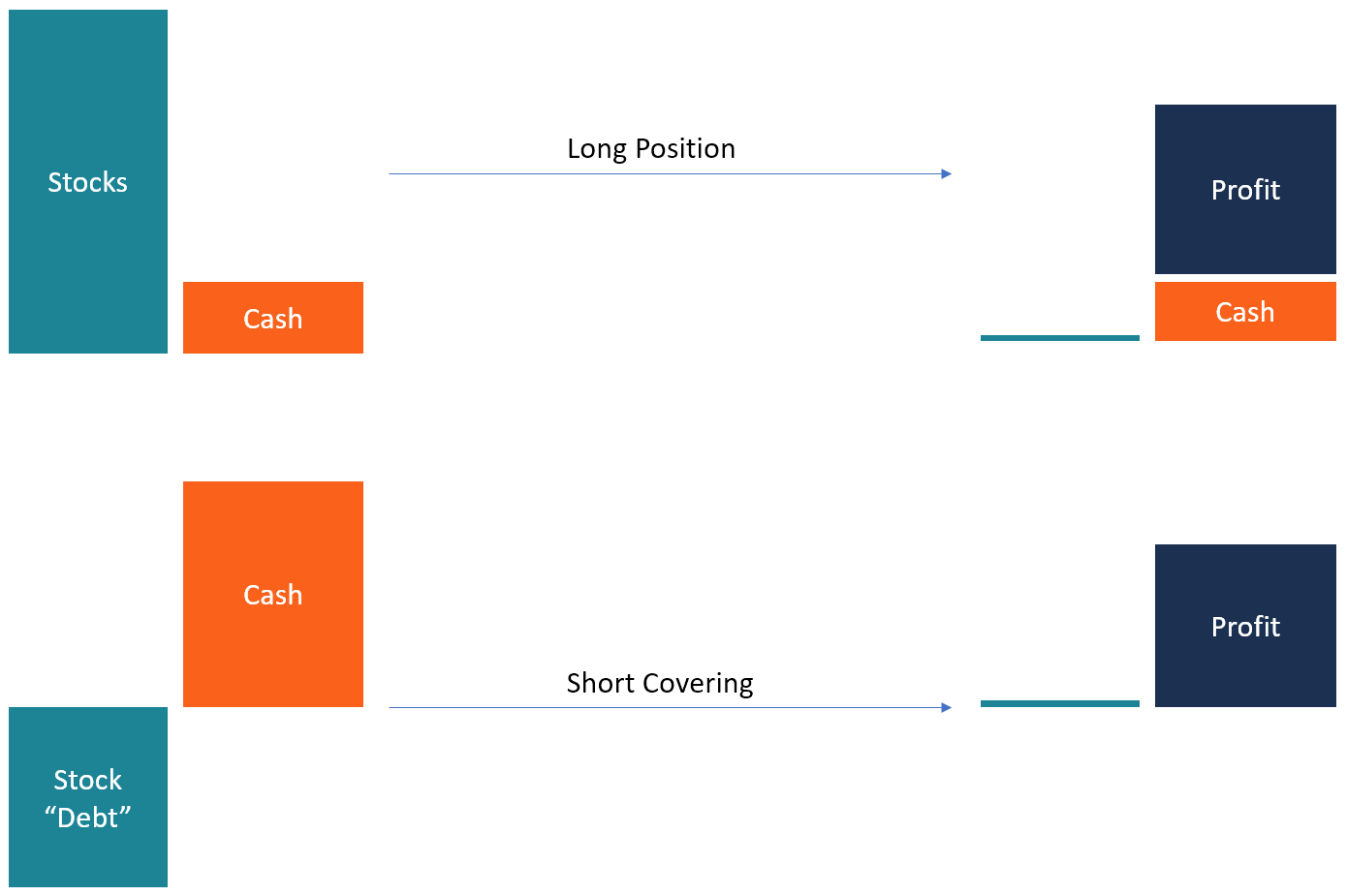

How to buy to cover. When an investor buys shares of a stock, they are said to be “long” the stock. A buy to cover limit order is an order used to attempt to cover (close) a currently open short position at a price that is lower than the current market price. This means that they expect the stock price to increase so that they can sell the shares.

The first step is to choose from our designs. Covering at a gain vs. When the time comes to cover the.

You can purchase stocks at. Buying to cover is different than. The process is closely related to short.

Buying to cover is more like selling than buying. It is suitable for investors who want to take advantage of a falling. Most of these tokens (70%) are released via the liquidity mining program over a period.

An album cover is a piece of image that artists, specially musicians and music producers, place on their music. When you buy to cover you don’t actually own any shares. What is ‘buy to cover’?

Currently, you can place buy to cover and sell short orders on fidelity.com. The term “buy to cover” refers to placing a market order intended to close a short position, restoring borrowed shares used in a transaction to the lender. Cover is the token for cover protocol with a max cap of 160,000 cover tokens.

/GettyImages-1150100051-7f93169bfd494c82a769316ad0ce4156.jpg)